#155 - Interview

🇬🇧 Dollar, Debt, Bitcoin... Can the monetary system hold ?

Debt, energy, Bitcoin, dollar and power… the invisible architecture of modern finance and where it’s going.

Écouter sur :

🇫🇷 fr

Debt, energy, Bitcoin, dollar and power… the invisible architecture of modern finance and where it’s going.

What is money, really?

In this episode, we explore the deep structures behind our financial system with macro strategist Lyn Alden. We talk about money as a ledger, the link between finance and energy, the illusion of endless growth, and the hidden consequences of debt and leverage.

What happens when monetary claims grow faster than the physical world they rely on?

Can a decentralized system like Bitcoin really change the game?

And why does understanding money mean understanding power?

Julien Devaureix

Hello, Lyn.

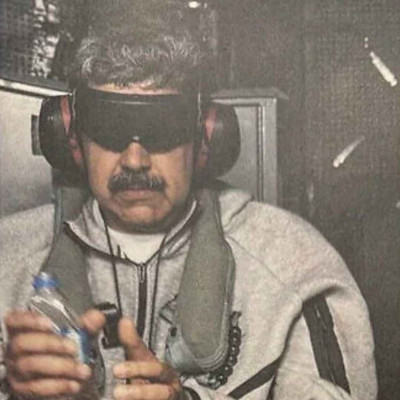

Lyn Alden

Hello, how are you?

Julien Devaureix

I’m great. You’re in the US, I’m in Europe, and somehow we’re able to have this conversation. That’s amazing, isn’t it?

Lyn Alden

Yes, it’s one of the marvels of modern technology.

Julien Devaureix

Exactly. We tend to forget it. We’ll talk a bit about technology later. We’ll also talk about money, the economy, and crypto. To start, could you introduce yourself and explain what you do and how you got there?

Lyn Alden

Sure. My name is Lyn Alden. I started out as an engineer, specifically an electrical engineer working on aircraft simulation electrical systems. I eventually became head engineer at that facility, which focused on research for aircraft simulation.

Alongside that work, I began writing about investments on my own blog. When I was choosing a university path, my two main interests were engineering and finance. I chose engineering but kept finance as a parallel interest. Over time, the blog grew, I sold it to a larger publisher, and in 2016 I launched lynalden.com, which I still run today.

Eventually the work became large enough that I had to choose between engineering and finance, and I decided to focus fully on the latter. What I tend to do is apply systems engineering principles to finance, especially capital flows. These are human-designed systems with inputs, outputs, and governing rules, much like engineered systems. That lens allows me to analyze aspects of the financial system in ways that aren’t always obvious to people working within it.

In 2023, I published Broken Money, which explores the history of money through the lens of technology, past, present, and future. I’m also a general partner at Ego Death Capital, a venture firm.

Julien Devaureix

That makes you a fairly original voice in the field. There aren’t many engineers talking about economics. I’d like to explore that lens more deeply. How does it shape your view of the economy?

Lyn Alden

Initially, my focus was traditional value investing. I didn’t rely much on my engineering background except when analyzing tech companies. The shift happened when I started focusing on capital flows.

For example, the US issues the world’s reserve currency. Most people focus on the benefits of that status, but fewer examine the downsides. The Triffin Dilemma identified some of those issues decades ago, but it hasn’t been meaningfully updated for the modern era.

I focus on the structural trade deficits created by reserve currency status. I also isolate the mechanisms of monetary and fiscal policy and their impact on inflation and the economy. For a long time, people either treated monetary and fiscal policy as the same thing or focused almost entirely on central banks. Since around 2020, the US has entered fiscal dominance, where fiscal policy has more impact than monetary policy.

Having an external, systems-based perspective helps navigate that transition. Engineering and finance both rely on quantitative reasoning, but systems thinking emphasizes how components interact. During the pandemic, I heard from people at major institutions who found my work helpful because it zoomed out and connected multiple dynamics rather than isolating individual variables.

Julien Devaureix

I’d like to understand how you position yourself among economic schools of thought. You’ve said you’re not strictly Austrian, not MMT, and not mainstream. What do you take from each?

Lyn Alden

The school that most closely aligns with my work is probably Austrian economics, with some overlap with monetarism. MMT is interesting because it accurately describes certain mechanisms, but where I disagree is often on assumptions about human behavior.

I try to take what’s useful from each framework. One example is the money supply. After the 2008–2009 crisis, many people predicted hyperinflation because of quantitative easing. That didn’t happen because broad money didn’t actually expand much beyond its existing trend.

Broad money is what matters most for price levels. In 2020, the situation was different. QE was combined with massive fiscal stimulus that reached households and businesses directly. That dramatically increased broad money, making inflation much more likely with a lag.

Those monetarist insights, which also appear in some Austrian thinking, proved very helpful. I don’t see myself as loyal to a school so much as committed to identifying mechanisms that actually matter.

Julien Devaureix

Money is central to our lives and yet deeply misunderstood. You define money not as a thing, but as a ledger, a shared record. Can you explain that?

Lyn Alden

In Broken Money, I combine two schools that are often presented as opposites: the commodity theory of money and the credit theory of money.

Commodity theory emphasizes attributes like durability, divisibility, scarcity, and salability. The best money is the most saleable commodity with strong network effects.

Credit theory argues that money originated as credit, not barter. David Graeber popularized this view, but it dates back to the early 20th century. In many early societies, people tracked obligations informally. Even today, friends often keep mental tallies of favors.

Both theories ultimately describe the same thing: a ledger. In a credit-based system, that ledger is maintained by institutions like central banks and commercial banks. In a commodity system, the ledger is maintained by nature. There is an objective reality about how much gold exists and who possesses it, even if no single person can see the full picture.

In both cases, money is a way of tracking value, debts, and claims on goods and services.

Julien Devaureix

When you say the ledger is run by nature, you mean the physical world?

Lyn Alden

Exactly. Commodity money is constrained by physical reality. You can’t easily increase its supply. That’s why not everything can function as money. If people used paperclips as money, someone would quickly mass-produce them and collapse the system.

As societies interacted, better forms of money displaced worse ones. Gold and silver outcompeted shells because they were harder to produce and more durable. Over time, societies converged on the best available monetary technologies.

Julien Devaureix

You also trace monetary evolution through information technology, from clay tablets to the telegraph to blockchain. Why is that dimension so important?

Lyn Alden

There are two parallel technological paths in money. One concerns what we use as money. The other concerns how ownership is transferred.

Coinage was a technology. Paper money was a technology. Anti-forgery techniques were analog encryption. The printing press dramatically lowered the cost of financial instruments.

The telegraph was the most important shift. Before it, information moved at the speed of matter. After it, information moved nearly at the speed of light. Transactions became fast, but settlement remained slow. Gold couldn’t move at the same speed as information.

That gap fundamentally changed the system. We relied on centralized ledgers to move IOUs while physical settlement barely occurred. This concentrated power and enabled leverage on a scale never seen before.

Julien Devaureix

Why does the gap between transaction speed and settlement speed matter so much?

Lyn Alden

Because the larger the gap, the more power intermediaries have. When transaction and settlement speeds were similar, people could fall back on physical money if they lost trust in institutions.

Once money could move across the world instantly while settlement remained slow, people became dependent on whoever ran the ledger. That led to a more leveraged and inflationary system, where speed became more important than scarcity.

Julien Devaureix

Many discussions about money ignore energy and physical constraints. How is money tied to the physical world?

Lyn Alden

Money buys goods and services, so it can’t be fully detached from physical reality. Hyperinflation occurs when money supply grows rapidly while production collapses.

Historically, physical constraints helped keep money honest. Nature doesn’t bend rules for anyone. Human-controlled ledgers are more prone to inflation and favoritism.

We live in a paradoxical system where productivity improves but prices are deliberately pushed upward. Central banks target rising prices even as technology lowers production costs. This creates redistribution effects that benefit those closest to money creation and disadvantage wage earners.

Julien Devaureix

Some goods get cheaper despite inflation, like electronics. Why?

Lyn Alden

Because productivity gains differ by sector. If productivity improves faster than money supply growth, prices fall. Electronics benefit from massive efficiency gains. Waterfront property does not.

Prices reflect the interaction between money growth and productivity growth. Where efficiency gains are weak, inflation dominates.

Julien Devaureix

Is there a limit to how much money we can print?

Lyn Alden

There’s no limit to units in an abstract sense. What matters is distribution. Printing becomes problematic when new money benefits some disproportionately.

In 2020, US households received a small fraction of total money creation. The rest went to corporations, banks, and asset markets. Early recipients benefit most, while later recipients face higher prices.

Money printing is an opaque form of redistribution.

Julien Devaureix

So when monetary claims grow faster than energy and resources, what happens?

Lyn Alden

Debt dynamics change. Productive debt increases future output. Arbitrage debt exploits cheap money without increasing productivity.

Cheap credit rewards those closest to issuance and punishes those without access. Fixed-rate debt holders benefit during inflation. Wage earners struggle to keep up.

It reshapes power structures in society.

Julien Devaureix

In simple terms, what is debt?

Lyn Alden

Debt is a claim on future resources. It ranges from informal social obligations to formal financial contracts. Today, it’s embedded in layered ledgers that span the globe.

The dollar’s reserve status exists partly because it dominates cross-border debt. Debt ultimately represents expectations about future purchasing power.

Julien Devaureix

What happens when debt grows faster than the real economy?

Lyn Alden

Defaults occur, either explicitly or through debasement. Countries that print their own currency often default via inflation rather than outright nonpayment.

Inflation defers consequences and obscures responsibility. It erodes purchasing power unevenly and often impacts people who didn’t benefit from the debt buildup.

Julien Devaureix

Why do some economists say debt isn’t a problem if GDP keeps growing?

Lyn Alden

They focus on surface stability. If productivity offsets money growth, prices remain stable. But underlying arbitrage still transfers wealth toward the center of the system.

Over time, these imbalances fuel populism. Policymakers often underestimate the cumulative effects.

Julien Devaureix

You often say “nothing stops the train.” What does that mean?

Lyn Alden

In the US context, it refers to persistent fiscal deficits. More broadly, it means total credit in modern systems can’t easily decline. Systems leveraged 20-to-1 can’t tolerate even small contractions.

Attempts to deleverage trigger crises, so authorities respond with money creation, reinforcing the cycle.

Julien Devaureix

Can you explain what 20-to-1 leverage means?

Lyn Alden

It means there are roughly 20 claims on money for every unit of base money. Bank deposits, bonds, and securities all represent IOUs layered on top of central bank money.

Most of the time it works because claims mature at different times. But when trust breaks, the system becomes unstable.

Julien Devaureix

Is eternal growth sustainable?

Lyn Alden

A debt-based system requires growth. Efficiency gains can provide some growth without resource expansion, but they have limits.

Material growth faces physical constraints. When systems are highly leveraged, even temporary slowdowns become crises.

Julien Devaureix

Let’s talk about the dollar system. What are the privileges and costs of issuing the global reserve currency?

Lyn Alden

The privilege is global demand for dollars and treasuries. The dollar dominates contracts, debt, currency exchange, and reserves.

This allows the US to run larger deficits without immediate crisis. The cost is deindustrialization. Trade deficits hollow out manufacturing while capital flows back into financial assets.

For other countries, dependence on the dollar exposes them to external shocks and policy decisions made elsewhere.

Julien Devaureix

What is the current US administration trying to do?

Lyn Alden

It’s trying to reduce trade deficits through tariffs. But the root cause is reserve currency status. You can’t eliminate trade deficits while supplying the world with dollars.

They’re addressing symptoms rather than causes.

Julien Devaureix

What problem does Bitcoin solve?

Lyn Alden

Bitcoin enables fast settlement without centralized control. It closes the gap between transaction speed and settlement speed.

It’s a decentralized base ledger with hard-to-change rules. It allows irreversible value transfer without relying on institutional trust.

Julien Devaureix

What about volatility, energy use, and scalability?

Lyn Alden

Bitcoin is volatile because it’s bootstrapping from zero. Volatility declines as adoption increases.

On energy, Bitcoin mostly uses stranded or wasted energy. Global gas flaring alone could power the network many times over. Bitcoin mining monetizes excess capacity and improves grid efficiency.

It already helps individuals. If it grows larger, it could challenge existing monetary structures.

Julien Devaureix

How are governments responding?

Lyn Alden

CBDCs increase centralization and surveillance. They misunderstand Bitcoin’s value, which lies in decentralization.

Stablecoins serve as offshore bank accounts for the global middle class. They’re imperfect but often preferable to local currencies.

Julien Devaureix

What shocks do you see coming in the next decade?

Lyn Alden

We’re in fiscal dominance. Debt isn’t going down. I expect sustained debasement, energy shocks, and a move toward a multipolar system.

Scarce assets will matter more. Sovereigns are reassessing dependence on external powers.

Julien Devaureix

Can governments still stabilize the system?

Lyn Alden

Their control diminishes as debt rises. At high debt levels, raising rates worsens deficits more than it slows private credit.

The risk is financial repression, surveillance, and capital controls.

Julien Devaureix

One key insight you’d like people to remember?

Lyn Alden

Technology reshapes power more durably than politics. Understanding money, energy, and technology is essential.

Protect yourself by minimizing dilution. Focus on assets where your share isn’t shrinking.

Julien Devaureix

Two books everyone should read?

Lyn Alden

The Lessons of History by Will and Ariel Durant. It’s short and offers exceptional perspective.

Julien Devaureix

Thank you so much, Lyn. This was incredibly insightful.

Lyn Alden

Thank you. It was a pleasure.

If you want, I can next:

produce a shortened editorial cut,

extract key quotes,

or adapt this into a written article for Sismique.

Soutenez Sismique

Sismique existe grâce à ses donateurs.Aidez-moi à poursuivre cette enquête en toute indépendance.

Merci pour votre générosité ❤️

Nouveaux podcasts

Fierté Française. Au-delà du mythe d’un pays fragmenté

Comprendre le malaise démocratique français. Attachement, blessures et capacité d’agir

Les cycles du pouvoir

Comprendre la fatigue démocratique actuelle et ce vers quoi elle tend.

"L'ancien ordre ne reviendra pas"... Analyse du discours de Mark Carney à Davos

Diffusion et analyse d'un discours important du premier ministre du Canada

Écologie, justice sociale et classes populaires

Corps, territoires et violence invisible. Une autre discours sur l’écologie.

Opération Venezuela : le retour des empires

Opération Absolute Resolve, Trump et la fin de l’ordre libéral. Comprendre la nouvelle grammaire de la puissance à la suite de l'opération "Résolution absolue".

Vivant : l’étendue de notre ignorance et la magie des nouvelles découvertes

ADN environnemental : quand l'invisible laisse des traces et nous révèle un monde inconnu.

Les grands patrons et l'extrême droite. Enquête

Après la diabolisation : Patronat, médias, RN, cartographie d’une porosité

Géoconscience et poésie littorale

Dialogue entre science, imagination et art autour du pouvoir sensible des cartes